What Kind of Investment Company Hires Professionals to Manage the Investments of a Pool of Investors

What is an Asset Direction Company (AMC)?

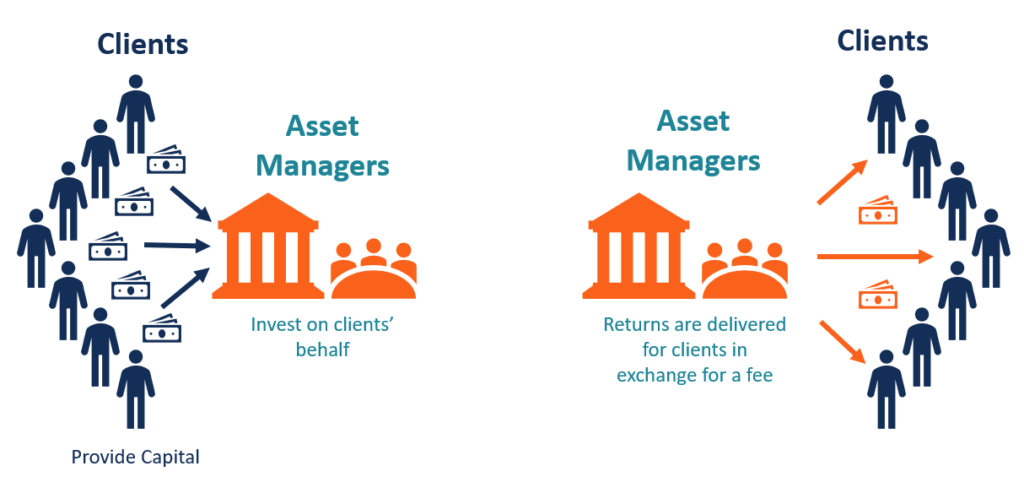

An asset direction company (AMC) is a house that invests a pooled fund of capital on behalf of its clients. The capital is used to fund dissimilar investments in various asset classes . Nugget management companies are commonly referred to as coin managers or money management firms as well.

Unlike Types of Nugget Direction Companies

Asset management companies come up in many dissimilar forms and structures, such as:

- Hedge funds

- Common funds

- Index funds

- Commutation-traded funds

- Individual equity funds

- Other funds

In addition, they invest on behalf of various types of clients, such as:

- Retail investors

- Institutional investors

- Public sector (authorities organizations)

- Individual sector

- Loftier-net-worth clients

Asset Management Companies Explained

Individual investors usually lack the expertise and resources to consistently produce strong investment returns over time. Therefore, many investors rely on asset management companies to invest uppercase on their behalf.

Asset management companies are usually a group of investment professionals with broad market expertise. With a large amount of pooled uppercase, they are able to apply diversification and circuitous investment strategies to generate returns for investors.

AMCs by and large charge a fee to their clients that is equal to a percentage of total avails under management (AUM). AUM is simply the full corporeality of capital letter provided by investors.

An nugget direction fund may charge a 2% fee on AUM. Consider every bit an case an asset manager who oversees a $100 meg fund. The fees for i yr or another time period will be $2 million ($100 million x ii.0%).

Hedge funds are notorious for charging much college fees, sometimes upwards of 20%. However, hedge funds utilize more than unorthodox and aggressive investment strategies to generate returns.

Purchase-Side vs. Sell-side

Nugget management companies are referred to as "buy-side" firms. It means that they help clients to purchase investments. They make decisions based on which investments to purchase.

In contrast, "sell-side" firms, such as investment banks and stockbrokers, will sell investment services to buy-side companies and other investors. Sell-side companies provide market inquiry and aid to inform buy-side firms with valuable data to entice the buy-side firms to execute transactions with them.

Benefits to Asset Direction Companies

There are various benefits to pooling capital together, including:

1. Economies of scale

Economies of scale are the cost advantages that a company tin can gain from increasing the scale of operations. With larger operations, the per-unit costs of operating are lower.

For example, asset management companies tin buy securities in larger quantities and can negotiate more favorable trading committee prices. Also, they can invest a lot of capital letter in a unmarried office, which reduces overhead costs .

2. Access to broad nugget classes

Access to wide nugget classes ways that asset management companies can invest in asset classes that an individual investor volition not be able to. For example, an AMC tin invest in multi-billion-dollar infrastructure projects, such equally a power found or a bridge. The investments are so large that an individual investor will not usually be able to admission them.

iii. Specialized expertise

Specialized expertise refers to asset management companies hiring finance professionals with all-encompassing experience in managing investments that most individual investors lack. For example, an AMC can hire various professionals who specialize in certain asset classes, such equally real estate, fixed income, sector-specific equities, etc.

Downsides to Nugget Direction Companies

Asset management companies come up with a few downsides as well, such equally:

1. Management fees

Most asset managers charge flat fees that are collected no matter what their performance was. As a upshot, over time, the fees can become very expensive for investors. Because of the costs for the resources and expertise required to run an AMC, the fees are high to compensate for such costs and to provide asset managers with a turn a profit every bit well.

ii. Inflexible

Asset managers can become besides big to a bespeak where they are cumbersome and unresponsive to the dynamic market. Managing too large of an amount of uppercase creates operational bug at times.

three. Hazard of underperforming

Typically, the performance of AMCs are evaluated in comparing to a criterion. A benchmark is a standard to compare performance against, unremarkably in the grade of a broad marketplace index. There is the risk that nugget managers underperform the markets, and if including the direction fees mentioned earlier, information technology can become very costly for investors.

Additional Resources

Thank you for reading CFI's guide on Nugget Management Company (AMC). To proceed advancing your career, the additional CFI resource below will be useful:

- Assets Under Management (AUM)

- Institutional Investor

- Management Expense Ratio (MER)

- Venture Capital Fund

octomancleaskulty.blogspot.com

Source: https://corporatefinanceinstitute.com/resources/knowledge/trading-investing/asset-management-company-amc/#:~:text=An%20asset%20management%20company%20(AMC)%20is%20a%20firm%20that%20invests,the%20same%20rules%20and%20regulations..